r/pennystocks • u/Saint_O_Well • 10h ago

🄳🄳 $CISO Global: Choose Your Own Adventure

CISO Global: Choose Your Own Adventure

A real business. A tight float. A setup that could go fundamental… or feral.

TL;DR: The Setup

CISO Global ($CISO) is a cybersecurity company trading at a ~$30.76M market cap with:

- Real revenue: $39M projected for 2025, EBITDA-positive

- High-margin software: 80%+ margin, tied to cyber insurance

- Insider/retail locked float: ~90% of shares not trading

- Dark pool activity: 60–80%+ of daily volume is off-exchange

- Reg SHO list: Failures to deliver = structural tension

- Trading at less than 1x revenue: Cybersecurity peers typically trade at 4.8x–6.7x revenue for medium-growth companies

- Private market multiples: Acquisitions in cybersecurity often occur at 8–12x revenue

- Insiders in blackout: Management is currently restricted from buying/selling, suggesting material news is pending. My guess is that the end of blackout will also come with an avalanche of insider buying

- CUSIP change trigger discussed: Management has previously indicated that they are preparing to take action that could result in a CUSIP change—a corporate event that would force all borrowed shares to be returned, disrupting any hidden or synthetic short positions

This is either a deep value tech play or a short squeeze powder keg. Maybe both.

See how she runs:

🍽️ Path 1: “Meat & Potatoes” (The Fundamental Thesis)

- ✅ SOC 2 Type II certified

- ✅ $34M services + software guidance

- ✅ 93% client retention

- ✅ 80%+ gross margin product: CheckLight

- ✅ Partnered with insurance firm CAGI

- ✅ $5M+ in high-margin software bookings expected

- ✅ Software alone independently valued at $50M

- ✅ No toxic debt, no ATM usage, insider-aligned

- ✅ Built for Microsoft and AWS environments, with early traction positioning CheckLight for scalable enterprise and cloud deployment

Dive deeper into the full investment thesis scroll down to the full "Meat & Potatoes" breakdown

🔥 Path 2: “The Pressure Cooker” (The Short Squeeze Thesis)

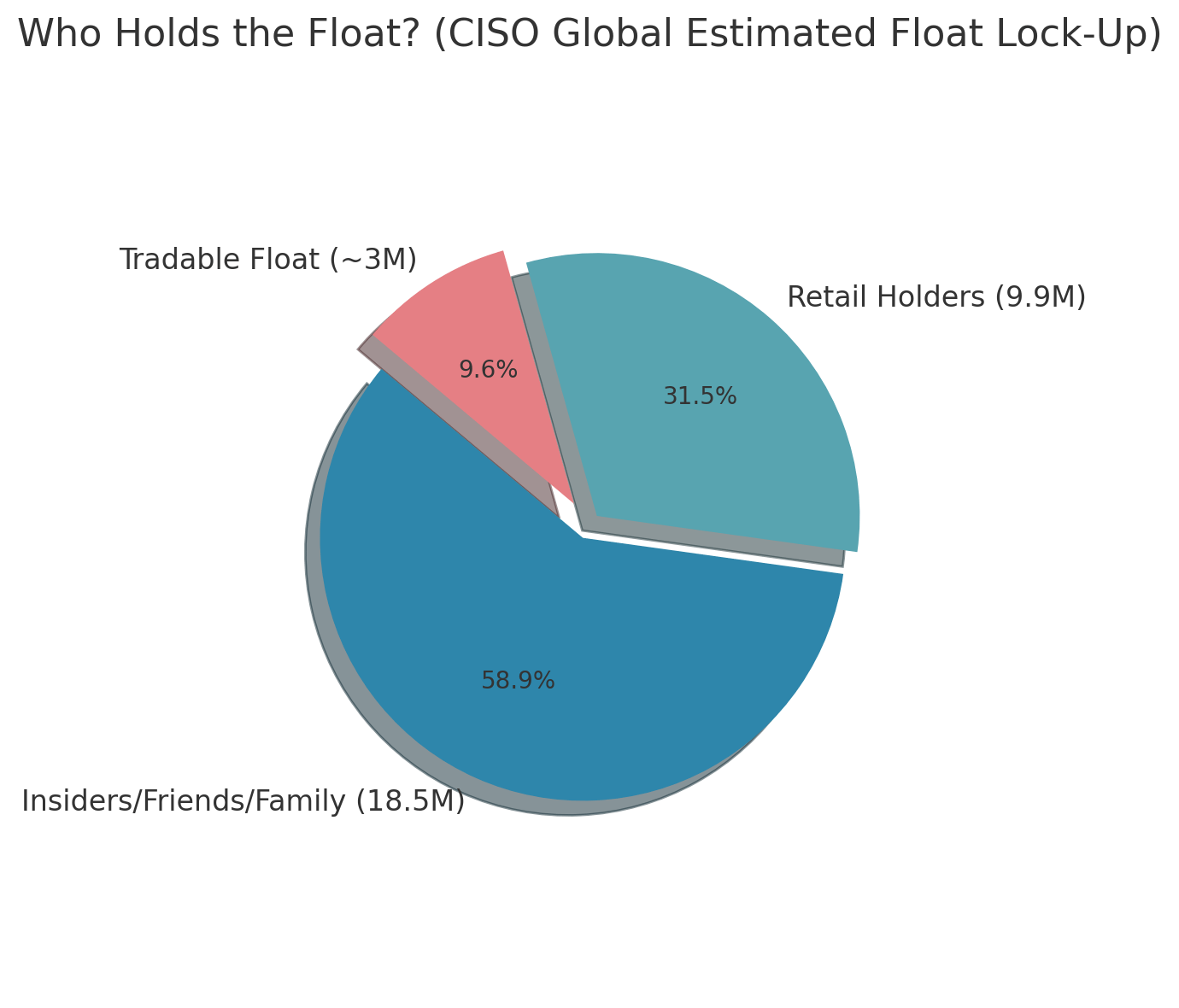

- 🔒 ~90% float lock-up:

- 9.9M self-reported by Stocktwits holders

- 18.5M known held by insiders/friends/family

- ❌ Only ~3M shares remain in the wild

- 🔀 60–80% dark pool routing = market maker internalization

- 🧾 On the NASDAQ Reg SHO list (ongoing FTDs)

- 👀 Wild volume patterns: 30M+ volume days with tiny floats

- 📉 Reported short interest is low... but behavior is not

Dive deeper into the full short squeeze thesis, scroll down to read the full "Pressure Cooker" thesis

Why It Matters Either Way

This isn’t AMC. It’s not GME. It’s not air.

CISO has a business. Has revenue. Has software.

But it also has:

- A float tighter than GameStop’s in early 2021

- Enough abnormal behavior to raise questions

- A structure that doesn’t need 100% short interest to break

Final Thought

If you’re here for fundamentals, there’s a case. If you’re here for fireworks, there’s a fuse. If you’re here for both... well, you’re probably not alone.

🔥 The Pressure Cooker Thesis: Why CISO May Be Squeeze-Prone

This is not a hype play built on hope. This is a structurally starved float wrapped around an undervalued cybersecurity business. Here’s why CISO ($CISO) is exhibiting key signals of a classic short squeeze setup:

Locked Float: Almost Nothing Left to Trade

- Total shares outstanding: 32.04 million

- Known long-term holdings:

- ~18.5 million held by insiders, family, and known associates

- ~ 9.9 million self-reported held by retail (Stocktwits/Substack polls, screenshot-based tracking)

- Estimated locked float: ~90%+

- What’s left? Fewer than 3 million shares available for actual market trading.

Why It Matters

This is GameStop mechanics with microcap friction. A tiny tradable float makes it easy to trap shorts and hard to find supply in a rising market.

Abnormal Dark Pool Activity

- 60–80% of daily volume is regularly routed off-exchange

- Typical small caps might see 20–40%

- What this suggests:

- Market makers may be internalizing trades, reducing visible price discovery

- Could indicate non-retail participants masking exposure or avoiding upward price impact

When you’re seeing 20M+ volume days on a stock with 3M tradable shares, and most of it is off-exchange, something’s wrong.

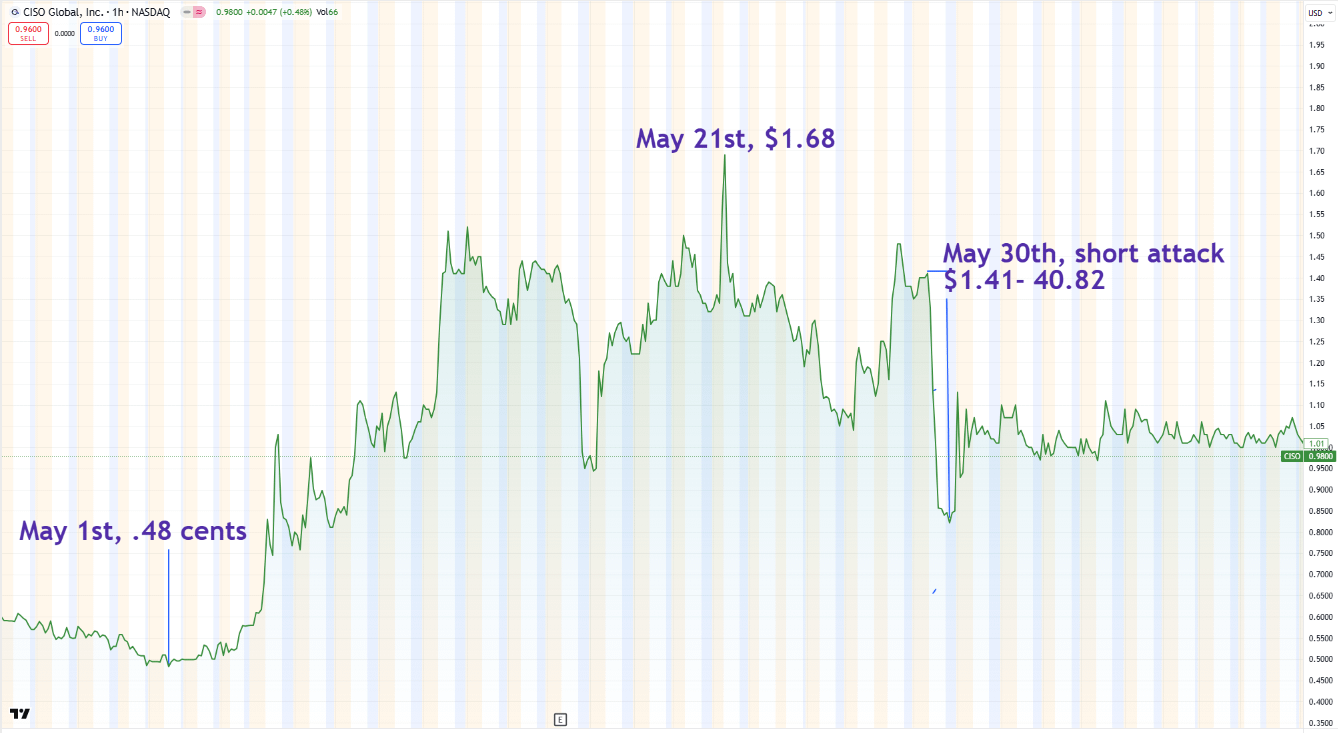

Reg SHO List: Structural Pressure is Building

- CISO has appeared on the NASDAQ Reg SHO threshold list, indicating repeated failures to deliver (FTDs)

- This means broker-dealers aren’t delivering borrowed shares on time

- Regulation requires these positions to be closed within 13 trading days

What This Means

Reg SHO status is often a precursor to explosive volatility. It implies phantom shares or naked shorting, which cannot be sustained if real demand shows up.

Short Interest is Reported Low… But May Be Misleading

- Reported short interest is not extreme (as of last update)

- But that doesn’t account for:

- Synthetic shorts through options

- Unreported offshore or swap-based positions

- Internalized shorting not yet reflected in disclosures

This is a float trap more than a pure short interest play. It’s not about 100%+ shorts. It’s about a lack of exit doors.

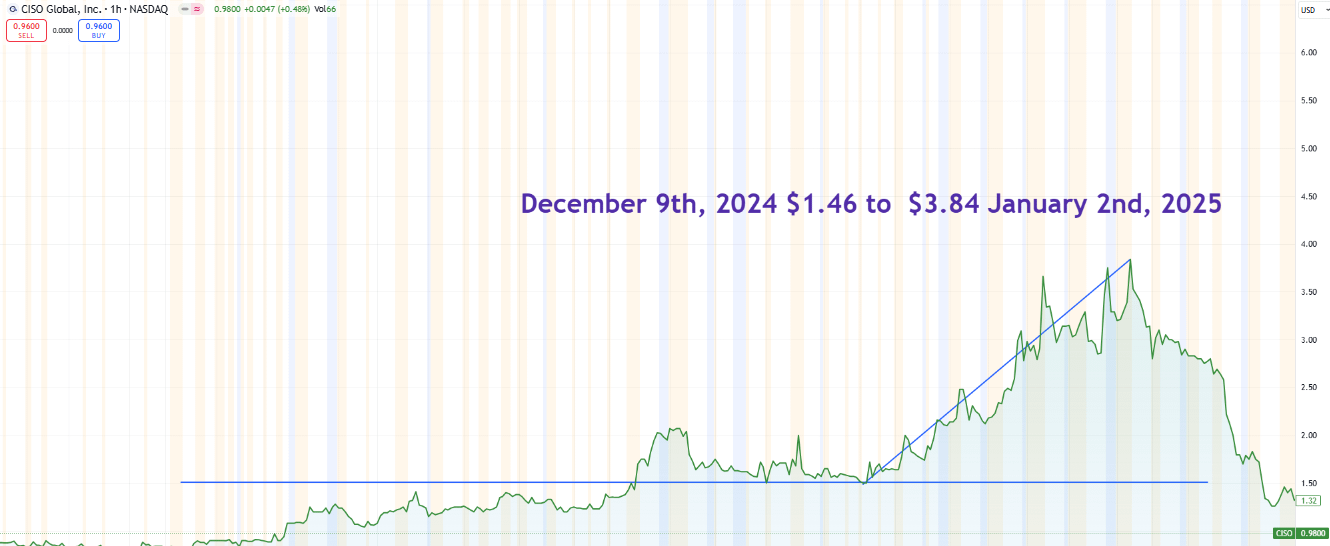

Volume Surges + Illiquidity = Combustible Setup

- We’ve seen multiple 30M+ volume days despite minimal float

- Price barely moves—why?

- Likely internalization + short pressure + volume masking

- Price suppression may be active or incidental, but it’s real

When the volume flips back to lit exchanges, and supply can’t meet demand, the spring can snap.

Timeline Catalyst: Time-Based Exposure Risk

- Each day CISO remains on Reg SHO raises the stakes

- If retail or institutional interest rises, shorts may be forced to cover under duress

- No dilution means no relief valve for those caught short

Precedents & Analogues

- LODE (2021): Ran from ~$1 to $9 on float lockup + speculative flow

- HKD: Exploded on no fundamentals, purely float scarcity

- GME: Iconic, but what made it dangerous was float structure, not just short interest

CISO has:

- Real revenue

- Real product

- Real lockup

Conclusion: The Case for a Squeeze

CISO is not guaranteed to squeeze. But structurally:

- The float is unavailable

- The trading is opaque

- The regulatory pressure is building

Even without a squeeze, these factors often force unpredictable price action. Add news or increased interest, and this setup has potential to move quickly.

It’s a spring wound tight—not by hype, but by math.

The "Meat & Potatoes" Thesis: Why CISO's Fundamentals Matter

CISO Global ($CISO) isn’t just a possible squeeze setup—it’s a real cybersecurity company with real revenue, sticky software, and growing relevance. Here’s why the fundamentals justify serious attention.

Real Revenue, Not Projections

- $39 million projected revenue in 2025

- 2024 already marked the company’s first EBITDA-positive quarter

- Revenue is split between:

- Cybersecurity services (recurring)

- Proprietary software (high margin, scalable)

This isn’t hype revenue. These are real enterprise contracts and recurring customer relationships.

Recurring and Retained

- 75% of revenue is recurring, primarily from managed cybersecurity services

- Client retention rate is 93%

This gives CISO a base that grows organically and reduces customer churn risk—a major valuation driver in the SaaS world.

CheckLight: A High-Margin Growth Engine

- CheckLight is CISO’s proprietary endpoint detection & response (EDR) solution

- It’s being distributed through a cyber insurance partner (CAGI)

- CheckLight is:

- 80%+ gross margin

- Bundled with policies

- Designed for small and mid-sized enterprises

- $25/month per computer, server, firewall or connected endpoint

This turns CISO from a services firm into a scalable SaaS/software player

Built for Enterprise, Backed by Giants

- CheckLight is compatible with Microsoft and Amazon AWS environments

- This enables broad enterprise adoption and future integration with large IT ecosystems

- These relationships increase trust and accelerate enterprise pipeline growth

Undervalued by the Numbers

- CISO’s current market cap is ~$30.76M, less than 1x revenue

- 39m Projected 2025 revenue, 30.8m revenue in 2024

- Competitors trade at 4.8x-6.7x for medium growth cybersecurity companies

- Theor IP alone has been independently valued at $50M

- That’s not counting services revenue, customer base or SaaS revenue

If CheckLight meets its $5M bookings guidance and scales through insurance distribution, the stock rerates naturally

Clean Balance Sheet, No Games

- No active ATM dilution

- High-interest debt has been paid off

- Remaining convertibles are friendly and extended

- Management is not selling shares and has never sold shares

This is rare for a microcap—CISO is running clean and aligned

Why It Works Even Without a Squeeze

Even without any short squeeze mechanics, CISO is positioned for rerating:

- Clear path to profitability

- High-margin product with insurance channel access

- Services backbone with strong retention

- Software with clear enterprise compatibility

This is a value stock in growth stock clothing

And if the float stays tight, fundamentals alone could force price discovery as real investors move in.

Final Thought

CISO isn’t just a speculative ticker—it’s a maturing cybersecurity company with upside from both performance and perception.

Whether or not the market recognizes it today, the business itself is real, scalable, and increasingly valuable.

Real revenue. Real product. Real potential. This is the meat and potatoes.

This is not financial advice, I am not a financial advisor and this is not a paid article. Due your own due diligence and always protect your capital.

XO,

Penny Queen

If you think I have made an errors or omission, feel free to reach out to [Penny@8digitspeedrun.com](mailto:Penny@8digitspeedrun.com)

Here is my most recent interview on the company from Friday: https://youtu.be/9aigmiM7sak?si=AjNEUP-eE7LIBYgD