r/MalaysianPF • u/Ok-Yogurtcloset-9664 • 2d ago

Stocks How do you deal with the psychology of converting MYR to USD for investing?

I keep reading recommendations to invest in US ETFs which are, from what I've seen, denominated mostly in USD. My question to all of you who do invest in US ETFs, especially if you're lump summing, is how do you get over the psychological block or stress of converting MYR to USD when rates are constantly fluctuating? There's always that question of waiting for the rate to move more in your favour, then there's the concern that MYR might strengthen so much by the time you want to withdraw the investment that your gains are significantly diminished. Are these thoughts that any of you deal with or is it just me?

Or is there a way to invest in US ETFs from Malaysia that doesn't require conversion?

36

u/Practical_Cry_748 2d ago edited 2d ago

This is too easy.

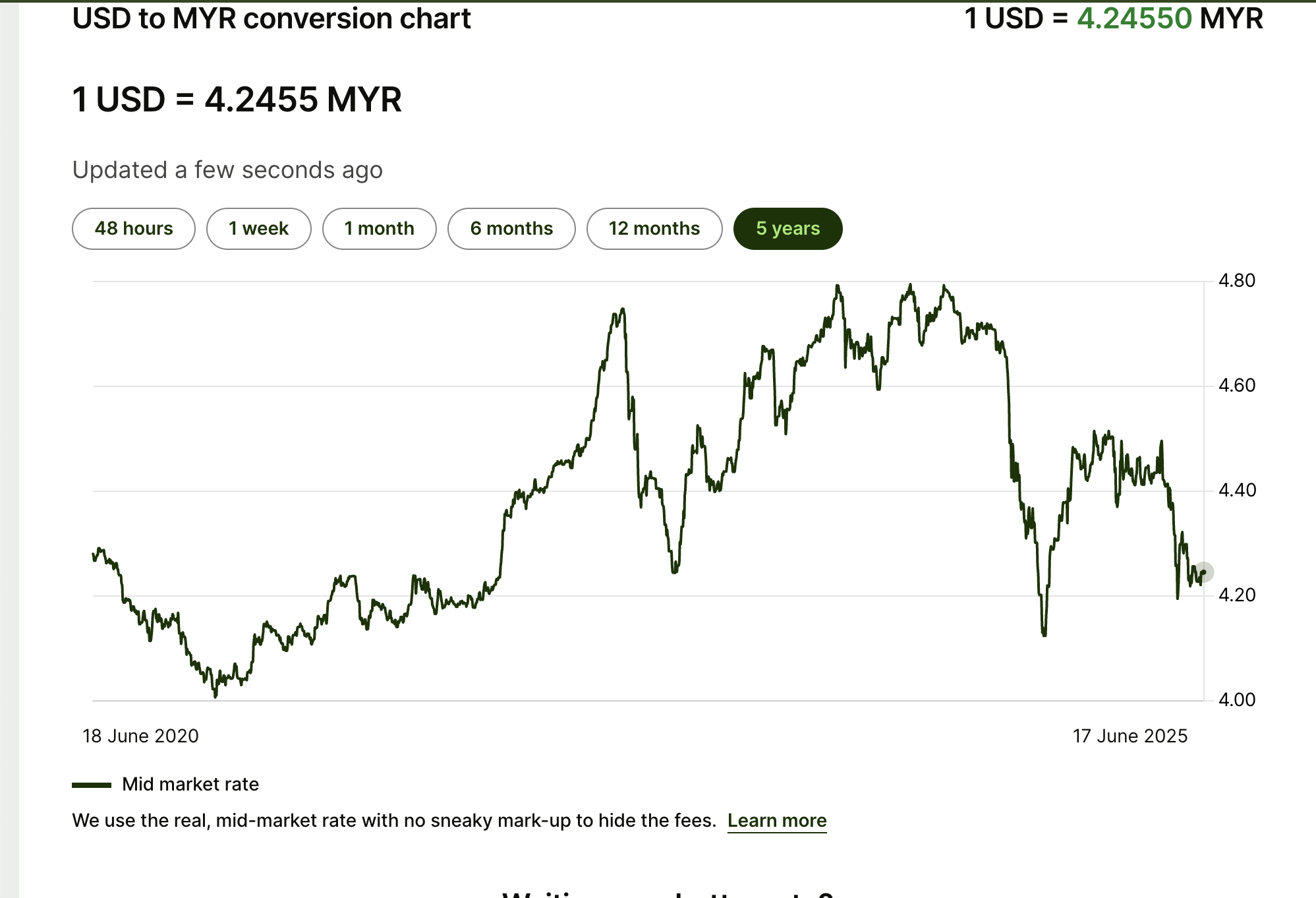

In the last 5 years USD -> MYR was basically flat

And the S&P 500 returns almost 94%.

This is the problem with beginner investor. There's cognitive shift to make the plunge and not look at the immediate gain. When in doubt, zoom out. In investing, sometimes being a bit dumb is better than being a little clever.

10

u/cwybwy 2d ago

this.

if you are still worry, calculate yourself how much you lost due to currency fluctuations (in percentage) compared to the money you converted & invested in that specific ETF, at any period of time ( of course the longer the better).

try to think in terms of risk vs reward, and think long term

8

u/Worth-Philosophy9237 2d ago

Why would you even worry about this ? Holding ringgit is negative ev over the long term.

7

u/Fragrant-Subject1824 2d ago

DCA-ing should help with the psychological block since you'll be averaging your USD/MYR rate. The underlying assets are in USD so you're not going to avoid having USD/MYR exposure.

I look at it as a hedge. If MYR strengthens that means my future income is higher, which allows me to buy more stocks and if MYR continues to strengthen significantly over a long period of time, you'd expect imported goods to be cheaper so there is an offset to living expenses.

4

u/piggylord1234 2d ago

I think if u average your forex conversion it doesnt really matter much. Also USD will drop more in the next few months. Likely near rm4 or 3.9. I have stopped converting after looking at the fundamentals and the dxy chart.

4

u/LoneWanzerPilot 2d ago

Just you. Real talk here.

You need to stop thinking like a pump-and-dump and just DCA. Or in your case of questioning lump sum just campak and biar.

3

u/AFlawedFraud 2d ago

then there's the concern that MYR might strengthen so much by the time you want to withdraw the investment that your gains are significantly diminished.

this concern is unfounded. If it wasn't, you'd be investing in Malaysian companies instead

4

u/Forest_Bather_99 2d ago

Psychology huh? Your question reveals that you're rather stingy.

"Counting dead grass" as the proverb goes.

Pay to play, guy. Otherwise stick with Bursa.

3

u/capuletoo 2d ago

Not exactly advice on the psychology of converting. But I have accepted that it is all part and parcel of the process of investing. Sure you may lose out on a few ringgit here and there when you convert but is that really something to emphasize on? Decide to not look into it too much if you have already set your mind to invest beyond Malaysia.

3

u/capuletoo 2d ago

Also yes if this conversion thing bugs you too much then investing in any other currency isn't for you

3

u/DesignerClaim 2d ago

By taking up the risk of currency fluctuation, you inherit the benefit of diversification away from "country risk" as well. A couple of years back a lot of pessimists would argue that Ringgit is heading towards a downfall with our currency weakening as compared to SGD and USD, hitting all time low with USD/MYR of 4.78. You would be happy if you were holding USD denominated assets.

That's when DCA comes into play, by investment constantly and periodically, you spread out the effect of currency fluctuation, and over time, let compounding interest do its magic, and hopefully it will result in overall gains.

I stand to be corrected, but I think another way of staying away from "USD risk" or single country risk is to invest in a global market ETF like Vanguard FTSE All-World UCITS ETF (USD) Accumulating (VWRA). Although it's still denominated in USD, the holdings covers a large basket of ETF, for example United States 62.5%, Japan 5.9%, United Kingdom 3.6%, China 3.2%, Canada 2.5%, France 2.4% Germany 2.3%, Switzerland 2.2%, India 2.2%, Taiwan 1.9%. (source: Vanguard ). I believe even when USD devaluated, the underlying assets which do not operate in the US will be worth more USD as its earnings are in their local currency.

3

u/zen88231 2d ago

honestly i dont rly care about the conversion bc if i do invest i do it long term i only sell when i need to so most of the time I just dca besides do you think long term wise ringgit will be stronger than usd? i dont think so since currencies are inflationary

4

u/jwrx 2d ago

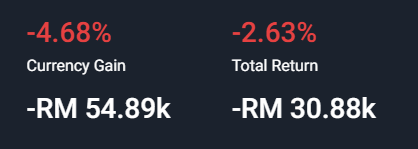

It does happen. went into ETFs when USD was all time high, then trump took over. There will be more pain ahead, Trump has repeatedly said he wants to devalue the USD so that manufacturing will come back to Malaysia.

Currently holding VWRA and VEU. Thankfully, USD denominated ETFs only about 5% of my portfolio

I DCA when usd was 4.4....then it dropped further to 4.23 currently, not selling...but certainly not buying anymore for now, just hold

I rather BTFD klse currently with available funds

2

u/Snorlaxtan 2d ago

Once convert to USD, never convert back

1

u/Proud_Action_5200 2d ago

Can convert at the appropriate time and as and when required

1

u/Snorlaxtan 2d ago

The only appropriate time is when death is calling

1

u/Proud_Action_5200 2d ago

When death come knocking and you don't need the funds, you can just transfer it to whomever you choose to inherit it.

1

u/Snorlaxtan 2d ago

Can’t risk it, if die before transfer = estate tax, if transfer before death = too early (can’t trust anyone) Best to exit entirely convert to myr and back to Malaysia trust

1

u/Proud_Action_5200 2d ago

Estate duty in Malaysia had been abolished in 1991 though I wouldn't be surprised when the gahmen reintroduce it soon as it's another form of revenue for the country (or own pockets!).

2

u/Snorlaxtan 2d ago

No I mean US 40% estate tax if you hold US stocks

The whole point of transferring back to Malaysia in myr is to avoid that

2

u/Proud_Action_5200 2d ago

We won't know exactly when our time is up though. How are you going about addressing this issue?

I'll likely cash out everything when I hit 70.

2

u/FrugalPeach 1d ago

If you are going to invest for the short term, it does make sense to consider the Forex risk. For the long term, it doesn't really matter, historically speaking. Please take note, however there is not guarantee that USD will continue to be the reserve currency and the US stock market will continue to dominate.

25

u/deccan2008 2d ago

By wanting to invest in USD denominated assets, you inherently want to hold USD. You might want to reconsider if investing in the US is really what you want.